Alkimia/Usecases/payment: Difference between revisions

m (→INVOICE) |

|||

| (4 intermediate revisions by the same user not shown) | |||

| Line 33: | Line 33: | ||

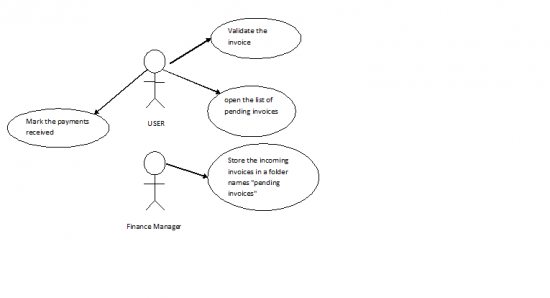

====USE CASE DIAGRAM==== | ====USE CASE DIAGRAM==== | ||

[[ | [[File:UseCase_Payment_Detection.png|550px|center]] | ||

---- | ---- | ||

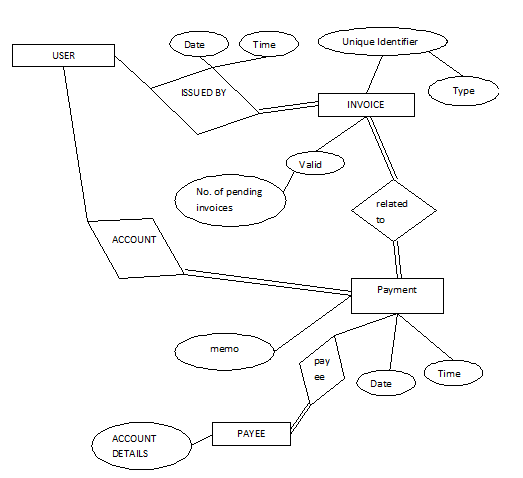

==DATA MODEL== | ==DATA MODEL== | ||

===ER Diagram=== | ===ER Diagram=== | ||

[[ | [[File:ER_DIG_Payment_Detection.png|550px|center]] | ||

===Entities=== | ===Entities=== | ||

====USER==== | ====USER==== | ||

| Line 49: | Line 50: | ||

;Related To | ;Related To | ||

#'''User:''' Who issued the invoice. | #'''User:''' Who issued the invoice. | ||

#'''Payment:''' which payment the invoice is processing. | #'''Payment:''' which payment the invoice is processing.A single invoice can have multiple payments. | ||

====PAYMENT==== | ====PAYMENT==== | ||

;Attributes | ;Attributes | ||

Latest revision as of 20:36, 17 June 2011

PAYMENT DETECTION

INTRODUCTION

As soon KMyMoney or Skrooge becomes aware of an incoming payment, either through online banking or manual entry, it should

- try to detect an unique identifier

- validate if there is an expected payment filed with this unique identifier

- if so, let the user validate if the detection is correct (optional)

- mark the payment to be received

Example: Elena issues an invoice with Kraft over 364 Euro, due in 10 days. She marks the invoice to be sent in Kraft. In KMyMoney and Skrooge the amount of 364 Euro shows up as expected money together with the document id number, date and addressee of the invoice. Four days later, Elena checks the accounts via online banking. One transaction record contains the document id and the finance manager asks Elena if she can confirm that this is the money paying the invoice. She confirms that.\\Next time she starts Kraft she sees that the invoice is marked as payed.

ACTORS

- USER

- Finance Manager

PRECONDITIONS

- must have an installed financial manager.

- law requirements must met for document identifier of the incoming voice.

- The coming invoice must have a unique identifier attached to it.

BASIC FLOW

- open the list of unchecked invoices.

- check the unique identifier any of the invoice and see which document type it is.

- The data which is used for detection should come as Key-Value pairs from the client, for example kraft would send this for a document:

Document-ID:4711

Name: Strawinsky

First Name: Elena

Document Type: Invoice - The Alkimia Service in turn would associate the strings with the created transaction.When a payment comes in, it searches for the strings "4711", "Strawinsky", "Elena" and "Invoice". If it finds for example "Elena", it would ask the user something like: "The online banking record XY contains the word Elena which is associated as First Name with the transaction Z.

This transaction expects a payment.

Is that online record representing the payment for the transaction?"

- The data which is used for detection should come as Key-Value pairs from the client, for example kraft would send this for a document:

- Ask user if the expected payment is filed with the unique identifier.

- If the user validates it then mark the payment to be received.

- update the changes.

ALTERNATE FLOW

- If the user says the unique identifier is invalid, then send the invoice to a “ invalid invoices" folder

USE CASE DIAGRAM

DATA MODEL

ER Diagram

Entities

USER

- Related To

Entity Invoice

INVOICE

- Attributes

- valid: If the invoice received is valid or invalid or is not even payed

So the valid can have 2 values: valid,invalid, or it can be NULL

the no. of invoices with NULL 'valid' value can be counted to form no. of pending invoices. - Unique Identifier: The unique identifier related to each invoice. It would be different for each and every invoice.It will also tell us about the type of invoice.

- Related To

- User: Who issued the invoice.

- Payment: which payment the invoice is processing.A single invoice can have multiple payments.

PAYMENT

- Attributes

- Payer: Who is the Payer?

- Date:

- Time:

- Account: Account where you received the Amount.

- Memo:

- Related To

- A single Payment can be processed by multiple invoices by splitting it and applying it against multiple invoices.